Housing Exclusion Definition . Web the foreign housing exclusion (fhe) allows americans living abroad to exclude some of their housing costs from their taxable income. Tax return if you live abroad. Web learn how to qualify for the foreign earned income exclusion, the foreign housing exclusion, or the foreign housing deduction. Find out who qualifies, what expenses you can exclude, and how to claim the foreign housing exclusion on form 2555. Tax if you meet certain residency or presence. Web the foreign housing exclusion and deduction is an allowance for taxpayers who live and work in a foreign country to. Web learn how to exclude up to $120,000 of your foreign income from u.s. Web learn how to claim a housing exclusion or deduction from gross income if you qualify under the bona fide residence. Web learn how to exclude or deduct rental housing expenses from your u.s.

from www.slideserve.com

Tax if you meet certain residency or presence. Tax return if you live abroad. Web the foreign housing exclusion and deduction is an allowance for taxpayers who live and work in a foreign country to. Web learn how to claim a housing exclusion or deduction from gross income if you qualify under the bona fide residence. Find out who qualifies, what expenses you can exclude, and how to claim the foreign housing exclusion on form 2555. Web learn how to qualify for the foreign earned income exclusion, the foreign housing exclusion, or the foreign housing deduction. Web learn how to exclude up to $120,000 of your foreign income from u.s. Web learn how to exclude or deduct rental housing expenses from your u.s. Web the foreign housing exclusion (fhe) allows americans living abroad to exclude some of their housing costs from their taxable income.

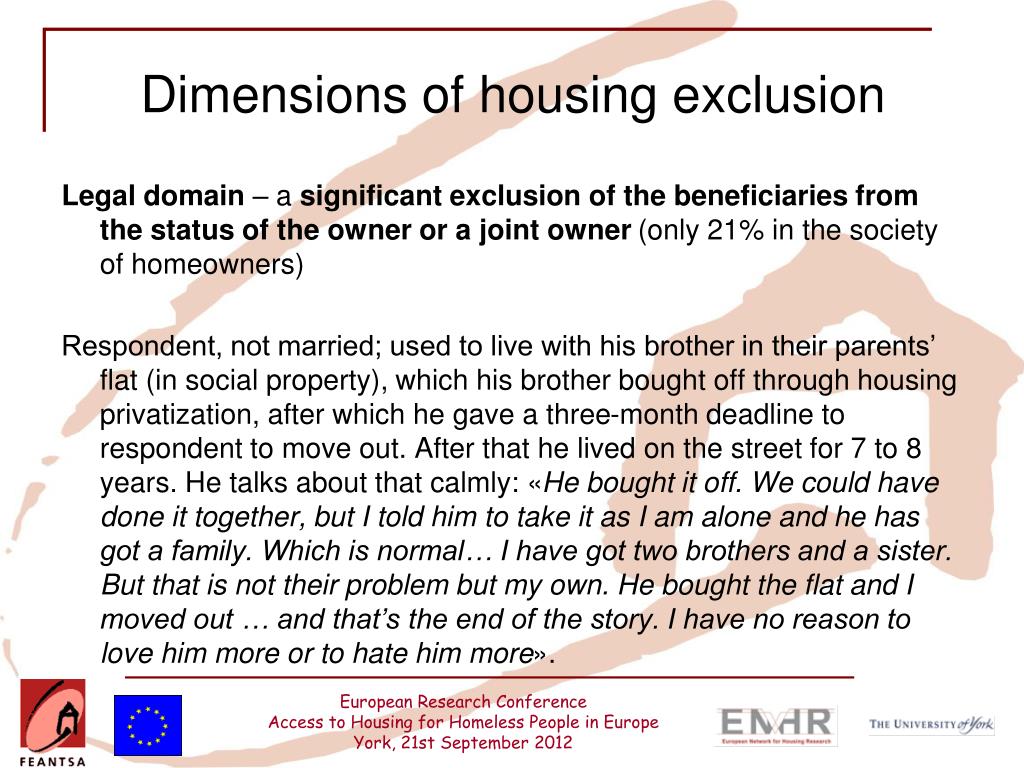

PPT Homelessness and Housing Exclusion in Serbia PowerPoint

Housing Exclusion Definition Web learn how to exclude or deduct rental housing expenses from your u.s. Web learn how to qualify for the foreign earned income exclusion, the foreign housing exclusion, or the foreign housing deduction. Tax return if you live abroad. Web learn how to exclude up to $120,000 of your foreign income from u.s. Web the foreign housing exclusion (fhe) allows americans living abroad to exclude some of their housing costs from their taxable income. Web learn how to exclude or deduct rental housing expenses from your u.s. Find out who qualifies, what expenses you can exclude, and how to claim the foreign housing exclusion on form 2555. Tax if you meet certain residency or presence. Web learn how to claim a housing exclusion or deduction from gross income if you qualify under the bona fide residence. Web the foreign housing exclusion and deduction is an allowance for taxpayers who live and work in a foreign country to.

From dokumen.tips

(PPTX) European Typology of Homelessness & Housing Exclusion Housing Exclusion Definition Web learn how to exclude up to $120,000 of your foreign income from u.s. Tax if you meet certain residency or presence. Web learn how to qualify for the foreign earned income exclusion, the foreign housing exclusion, or the foreign housing deduction. Tax return if you live abroad. Web learn how to exclude or deduct rental housing expenses from your. Housing Exclusion Definition.

From www.slideserve.com

PPT Housing exclusion and criminality PowerPoint Presentation, free Housing Exclusion Definition Web learn how to claim a housing exclusion or deduction from gross income if you qualify under the bona fide residence. Web the foreign housing exclusion (fhe) allows americans living abroad to exclude some of their housing costs from their taxable income. Web learn how to qualify for the foreign earned income exclusion, the foreign housing exclusion, or the foreign. Housing Exclusion Definition.

From www.feantsaresearch.org

6th Overview of Housing Exclusion in Europe 2021 Youth in Danger! Housing Exclusion Definition Web the foreign housing exclusion (fhe) allows americans living abroad to exclude some of their housing costs from their taxable income. Tax if you meet certain residency or presence. Web the foreign housing exclusion and deduction is an allowance for taxpayers who live and work in a foreign country to. Web learn how to exclude or deduct rental housing expenses. Housing Exclusion Definition.

From www.researchgate.net

ETHOS European Typology of Homelessness and Housing Exclusion Housing Exclusion Definition Web learn how to exclude up to $120,000 of your foreign income from u.s. Web learn how to claim a housing exclusion or deduction from gross income if you qualify under the bona fide residence. Tax return if you live abroad. Web learn how to qualify for the foreign earned income exclusion, the foreign housing exclusion, or the foreign housing. Housing Exclusion Definition.

From www.tandfonline.com

Explanations of Social Exclusion Where Does Housing Fit in? Housing Housing Exclusion Definition Tax if you meet certain residency or presence. Web learn how to qualify for the foreign earned income exclusion, the foreign housing exclusion, or the foreign housing deduction. Web learn how to exclude up to $120,000 of your foreign income from u.s. Web the foreign housing exclusion and deduction is an allowance for taxpayers who live and work in a. Housing Exclusion Definition.

From www.slideserve.com

PPT Homelessness and Housing Exclusion in Serbia PowerPoint Housing Exclusion Definition Web learn how to qualify for the foreign earned income exclusion, the foreign housing exclusion, or the foreign housing deduction. Find out who qualifies, what expenses you can exclude, and how to claim the foreign housing exclusion on form 2555. Web the foreign housing exclusion (fhe) allows americans living abroad to exclude some of their housing costs from their taxable. Housing Exclusion Definition.

From www.feantsaresearch.org

6th Overview of Housing Exclusion in Europe 2021 Youth in Danger! Housing Exclusion Definition Tax return if you live abroad. Web learn how to claim a housing exclusion or deduction from gross income if you qualify under the bona fide residence. Find out who qualifies, what expenses you can exclude, and how to claim the foreign housing exclusion on form 2555. Tax if you meet certain residency or presence. Web learn how to exclude. Housing Exclusion Definition.

From housingrightswatch.org

Sixth Overview of Housing Exclusion in Europe Rent regulation Housing Exclusion Definition Web learn how to exclude up to $120,000 of your foreign income from u.s. Web learn how to qualify for the foreign earned income exclusion, the foreign housing exclusion, or the foreign housing deduction. Web the foreign housing exclusion (fhe) allows americans living abroad to exclude some of their housing costs from their taxable income. Tax return if you live. Housing Exclusion Definition.

From www.ustaxfiling.in

What Is the Foreign Housing Exclusion? US Tax Filing Housing Exclusion Definition Tax if you meet certain residency or presence. Web learn how to exclude up to $120,000 of your foreign income from u.s. Web the foreign housing exclusion (fhe) allows americans living abroad to exclude some of their housing costs from their taxable income. Web the foreign housing exclusion and deduction is an allowance for taxpayers who live and work in. Housing Exclusion Definition.

From www.researchgate.net

(PDF) Homelessness and housing exclusion. Impact, profile and Housing Exclusion Definition Find out who qualifies, what expenses you can exclude, and how to claim the foreign housing exclusion on form 2555. Web the foreign housing exclusion and deduction is an allowance for taxpayers who live and work in a foreign country to. Web learn how to exclude or deduct rental housing expenses from your u.s. Web the foreign housing exclusion (fhe). Housing Exclusion Definition.

From www.taxsamaritan.com

Foreign Housing Exclusion Interesting Facts You Need To Know Housing Exclusion Definition Find out who qualifies, what expenses you can exclude, and how to claim the foreign housing exclusion on form 2555. Web learn how to claim a housing exclusion or deduction from gross income if you qualify under the bona fide residence. Tax return if you live abroad. Tax if you meet certain residency or presence. Web learn how to exclude. Housing Exclusion Definition.

From www.expatustax.com

US Expat Benefit Foreign Housing Exclusion (Guidelines) Housing Exclusion Definition Tax if you meet certain residency or presence. Find out who qualifies, what expenses you can exclude, and how to claim the foreign housing exclusion on form 2555. Web the foreign housing exclusion and deduction is an allowance for taxpayers who live and work in a foreign country to. Web learn how to exclude up to $120,000 of your foreign. Housing Exclusion Definition.

From www.arrelsfundacio.org

Fourth overview of housing exclusion in Europe (2019) Arrels Fundació Housing Exclusion Definition Find out who qualifies, what expenses you can exclude, and how to claim the foreign housing exclusion on form 2555. Web learn how to qualify for the foreign earned income exclusion, the foreign housing exclusion, or the foreign housing deduction. Tax return if you live abroad. Web the foreign housing exclusion (fhe) allows americans living abroad to exclude some of. Housing Exclusion Definition.

From www.taxsamaritan.com

The Best Informative Facts About Foreign Housing Exclusion Housing Exclusion Definition Web the foreign housing exclusion and deduction is an allowance for taxpayers who live and work in a foreign country to. Web learn how to exclude up to $120,000 of your foreign income from u.s. Tax return if you live abroad. Web the foreign housing exclusion (fhe) allows americans living abroad to exclude some of their housing costs from their. Housing Exclusion Definition.

From www.scribd.com

Chapter 4 European Index of Housing Exclusion 2020 PDF European Housing Exclusion Definition Web learn how to qualify for the foreign earned income exclusion, the foreign housing exclusion, or the foreign housing deduction. Tax if you meet certain residency or presence. Find out who qualifies, what expenses you can exclude, and how to claim the foreign housing exclusion on form 2555. Web the foreign housing exclusion and deduction is an allowance for taxpayers. Housing Exclusion Definition.

From brighttax.com

The Foreign Housing Exclusion Complete Guide for Expats Bright!Tax Housing Exclusion Definition Web the foreign housing exclusion and deduction is an allowance for taxpayers who live and work in a foreign country to. Web learn how to exclude up to $120,000 of your foreign income from u.s. Tax if you meet certain residency or presence. Web learn how to exclude or deduct rental housing expenses from your u.s. Web learn how to. Housing Exclusion Definition.

From www.financestrategists.com

Foreign Housing Exclusion Definition, Eligibility, and Calculation Housing Exclusion Definition Web learn how to qualify for the foreign earned income exclusion, the foreign housing exclusion, or the foreign housing deduction. Web learn how to claim a housing exclusion or deduction from gross income if you qualify under the bona fide residence. Find out who qualifies, what expenses you can exclude, and how to claim the foreign housing exclusion on form. Housing Exclusion Definition.

From www.researchgate.net

(PDF) International Lessons on Tackling Extreme Housing Exclusion Housing Exclusion Definition Web the foreign housing exclusion and deduction is an allowance for taxpayers who live and work in a foreign country to. Tax return if you live abroad. Find out who qualifies, what expenses you can exclude, and how to claim the foreign housing exclusion on form 2555. Web learn how to exclude up to $120,000 of your foreign income from. Housing Exclusion Definition.